The Finance Bill 2024, which introduces new tax rates on locally manufactured vehicles among many others, comes into effect today.

This change marks a shift from a fixed tax rate to a value-based tax system, as outlined in the Finance Bill. Under the new tax regime, the tax on vehicles is no longer a fixed amount but varies according to the vehicle's value.

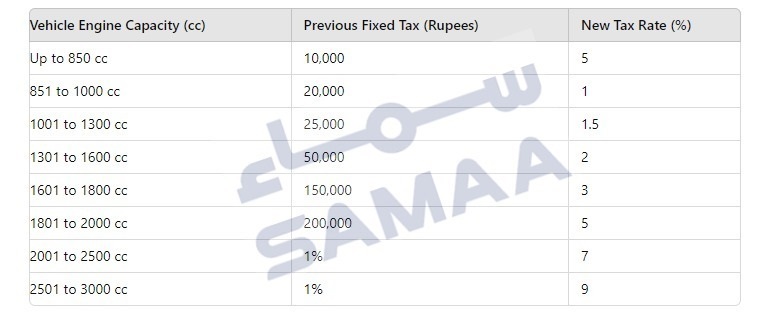

The updated tax rates are as follows:

- For vehicles up to 850cc, the tax rate is now 0.5%, replacing the previous fixed tax of Rs10,000.

- Vehicles ranging from 851 to 1000cc will be taxed at 1%, instead of the former fixed tax of Rs20,000.

- For vehicles between 1001 and 1300cc, a 1.5% tax rate is applied, replacing the previous Rs25,000 fixed tax.

- Vehicles from 1301 to 1600cc will be taxed at 2%, instead of the previous fixed tax of Rs50,000.

- For vehicles ranging from 1601 to 1800cc, the tax rate is now 3%, up from the previous fixed tax of Rs150,000.

- Vehicles between 1801 and 2000cc will face a 5% tax rate, replacing the earlier fixed tax of Rs200,000.

- For vehicles from 2001 to 2500cc, the tax rate has been increased from 1% to 7%.

- Vehicles in the 2501 to 3000cc range will now be taxed at 9%, up from the previous 1% increase.

These new tax rates are expected to have a significant impact on the pricing of locally manufactured vehicles, potentially leading to higher costs for consumers.

Also Read: Budget 2024-25: Luxury vehicle import tax exemptions scrapped

The government has implemented these changes as part of broader fiscal measures aimed at increasing revenue.

As the Finance Bill 2024 takes effect, it remains to be seen how the market will respond to these new tax rates and the overall impact on the automotive industry in Pakistan.