In response to widespread public outcry and opposition from various sectors, the government of Pakistan is contemplating a partial rollback of its ambitious tax proposals, particularly concerning income tax hikes on salaried individuals.

The move comes amidst escalating discontent over the proposed fiscal measures aimed at generating additional revenue amounting to Rs 1.5 trillion in the upcoming fiscal year.

The Finance Ministry, led by Muhammad Aurangzeb, has initiated internal consultations following severe backlash from taxpayers and businesses alike. The proposed budget, totaling 18.9 trillion rupees, represents a staggering 30% increase over the current fiscal year, yet faces mounting resistance for its heavy reliance on increased taxes rather than expenditure cuts.

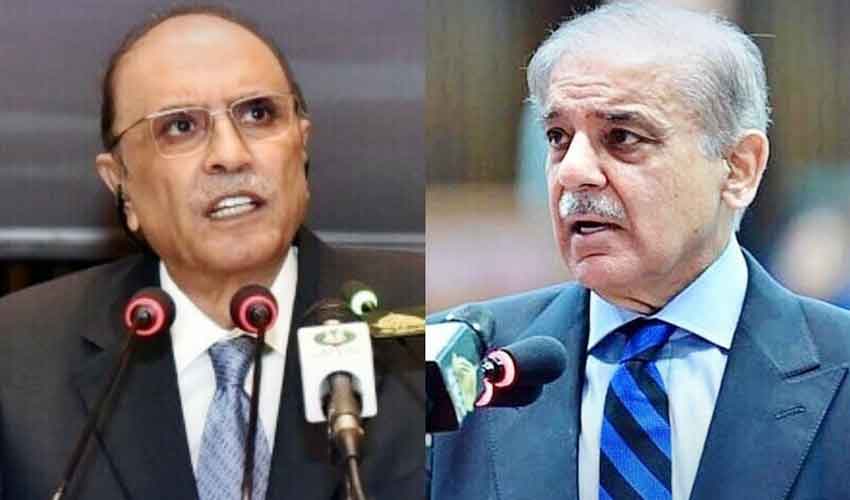

Prime Minister Shahbaz Sharif has been pressed by Finance Minister Aurangzeb to reconsider the substantial burden imposed on the salaried class, which has already contributed 360 billion rupees this year alone. Despite efforts to reduce this burden by 240 billion rupees, an additional 75 billion rupees in income taxes has been earmarked for the upcoming fiscal year.

Exporters, who have traditionally enjoyed a fixed income tax rate of 1%, are also slated to face gradual increases under the new proposals. Critics argue that such measures could jeopardize Pakistan's export competitiveness at a time when global economic uncertainties prevail.

Furthermore, contentious proposals such as an 18% sales tax on baby milk have sparked fierce debate. Stakeholders from the dairy industry warn that such a tax hike, if implemented abruptly, could lead to a significant spike in prices, burdening consumers already grappling with rising costs of living.

The Standing Committee on Finance, chaired by Senator Saleem Mandviwala, has emerged as a vocal opponent of these tax hikes. Mandviwala's committee has recommended a thorough review of the budgetary proposals, particularly the imposition of taxes affecting vulnerable groups like the salaried class and consumers of essential goods.

Chairman FBR, Malik Amjad Zubair Towana, has indicated openness to revisiting the proposed 18% sales tax on baby milk, suggesting a phased implementation instead. Industry leaders, including Nestlé Pakistan's Sheikh Waqar Ahmad, emphasize the potential hardships that an immediate tax hike on baby milk could impose on Pakistani families.

Meanwhile, the government's move to grant Pakistan International Airlines a 10-year deficit adjustment plan has drawn criticism from opposition figures like Senator Mohsin Aziz of Tehreek-e-Insaf. Aziz argues that such measures could amount to hidden incentives for potential buyers of state-owned enterprises, raising concerns over transparency and fiscal accountability.

In addition to tax policy revisions, the government has also proposed stringent measures such as banning non-filers from traveling abroad, a move aimed at expanding the taxpayer base and enhancing revenue collection.

With ongoing deliberations and consultations underway, the fate of these proposed tax revisions hinges on both Pakistan's financial capacity and its obligations under the International Monetary Fund's program, underscoring the delicate balance between fiscal consolidation and public sentiment.